India Post trying to increase biz

India Post plans to network 25,000 urban post offices by the end of this year and open 2,800 additional ATMs by March 2015

India Post is trying to increase business

by pushing customers to open post office savings accounts upon maturity

or early withdrawal of their small saving schemes. This comes at a time

when its chances of securing a banking licence from the Reserve Bank of

India (RBI) appear bleak due to inadequate infrastructure for banking

operations.

While India Post, which has about 155,000

branches across the country, has a wider reach, compared with 98,000

bank branches, it has only 287 million accounts, compared with 903

million bank accounts. Considering the entity’s banking aspirations,

more regular customers are significant.

“The process is complicated. They (India

Post) have applied under the new guidelines. So, they have to satisfy

the new criteria. Also, they will have to do what private banks do,”

said a finance ministry official.

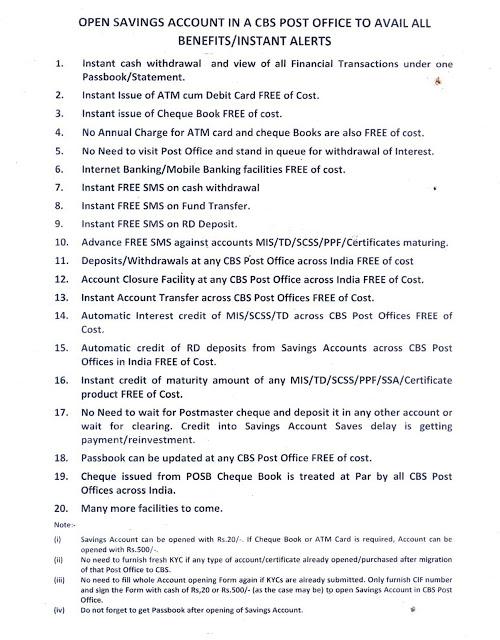

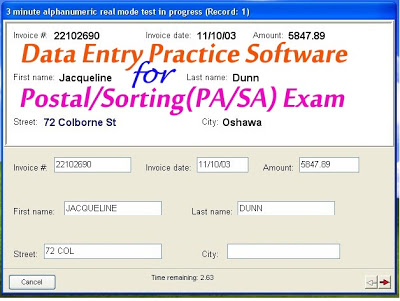

After the formal launch of core banking

solutions (CBS) for networking 100-odd branches last month, post offices

have apparently stopped issuing cheques to customers upon maturity of

their deposits in small savings schemes, National Savings Certificates

and public provident funds. The move is aimed at encouraging customers

to transfer these funds to post office savings accounts.

An official in the Department of Posts,

however, said there was no directive to force people to open savings

accounts in post offices. Customers were being encouraged to withdraw

money from automated teller machines (ATMs) so that they didn’t crowd

post office counters, he added. “There are many senior citizens, etc,

who come to withdraw their money at the end of the quarter or the year.

So, it is better to withdraw from ATMs.”

Postmasters could be encouraging those who

didn’t have accounts to open those, as this didn’t involve costs and

the money was automatically transferred to the savings account on the

same day, the official said. “So, it is easier and faster.”

Customers, however, argue managing

multiple accounts was inconvenient. They also reject the perception that

adopting CBS is leading to non-issuance of cheques. “The argument given

by the postal department is since it has moved to CBS, it cannot issue

cheques. However, banks that have had CBS for several years are still

issuing cheques using the same technology platform, Finnacle,” said

Rajesh Kumar, a post office customer from Assam. According to RBI

guidelines, withdrawals exceeding Rs 25,000 have to be carried out only

through cheques or transfers to savings accounts.

India Post plans to network 25,000 urban

post offices by the end of this year and open 2,800 additional ATMs by

March 2015. Better last-mile connectivity would help it strengthen its

case for securing a bank licence.

Private sector entities such as Reliance

Group, Aditya Birla Group, Bajaj Finance, Muthoot Finance, Religare

Enterprises and Shriram Capital have also applied for bank licences.

The Ministry of Communications and

Information Technology is planning to move the Cabinet to seek approval

for the funds required to India Post’s banking operations, in case it

secures a licence. Though the ministry has urged its finance counterpart

to allot Rs 623 crore to finance the proposed banking debut, the funds

have not been approved yet.

Comments

Post a Comment