Can Sonia, Rahul clarify why the Finance Ministry is blocking Post Bank of India?

Sonianomics

brandish at every possible opportunity, but when the world’s greatest

opportunity for financial inclusion knocks at the their door, they look

the other way.

The opportunity comes in the form of a private bank of the India Post,

which has 1.54 lakh branches across the country, 90 per cent which are in rural

areas. The Reserve Bank has approved the idea, but the finance ministry is

trying to block it.

Out of the 27 applicants (only 25 in the fray now) for a new banking

license, the Indian Post’s bank is among the five or six that has passed the

strict guidelines of the Reserve Bank. While other licensees can start their

operations once the Reserve Bank announces their clearances, the Indian Post’s

bank cannot because the finance ministry mandarins don’t like the idea.

Is there any particular reason that even with a Reserve Bank license an

arm of the government of India cannot start something that will help tens of

millions because another arm has a say over it?

The only motives that one can assume are the following.

1. Bureaucratic ego of the finance ministry: officers of the finance

ministry think that they are of a higher class than the officers of the humble

postal department. It’s simple arrogance of one ministry over another

2. Turf issues : Banking operations are overseen by the Department of

Financial Services (DFS) in the finance ministry. Why should the postal

services, whose job is to deliver post, should get involved in financial

services or banking?

3. Possible collusion with the public sector banks: DFS officials are on

the board of these banks, which may want to prevent competition from such a massive

network. Nobody can match the infrastructural strength of the postal services,

particularly in the rural areas.

Let’s take a look at the possibilities of the proposed bank of the

postal services called the Indian Post Bank.

Once operational, all the 1.54 lakh post offices, out of which about 90

per cent are in rural areas, by default will become a “bank”. These “banks”

will be more accessible to the common people, because they have been right

there for decades in their neighbourhood: there is a post office for every 7176

people in the country and in rural areas, the coverage is even better - one for

every 5682 people.

In fact, when the UPA government was struggling to find a way to

transfer the wages of NREGA beneficiaries, it was this network that came to its

rescue. About 2.2 crore people get their NREGA payments through post offices.

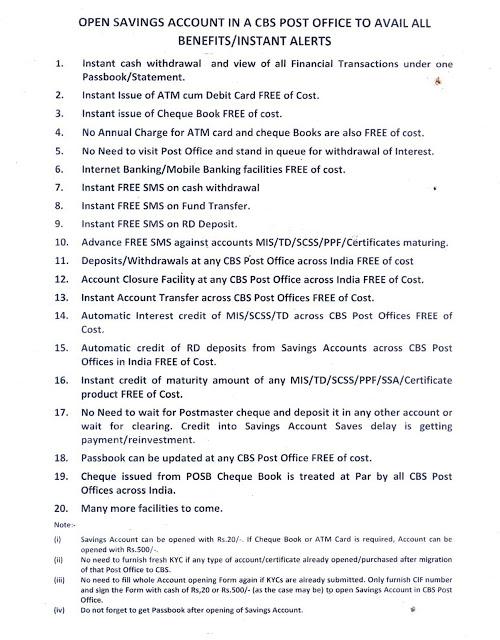

Financial services are not new to the post offices because for several

decades, they have been running the post office savings scheme. Besides the

extremely high penetration of the post offices, in rural areas, there are about

2.69 lakh agents (Grameen Dak Sevaks) who come home to help people with

banking.

Almost all these agents are also people from the neighbourhood and are familiar

with the beneficiaries. It is a unique banking eco-system that only Indian Post

can claim credit for. It is a model that has evolved over time and is very hard

to replicate because it is driven by the sheer needs of people, and nourished

by trust and relationships.

It’s impossible to find another system, than the Indian Post, that has

such penetration and coverage anywhere in the world. Unarguably, there is no

other network of such scale.

At present, the post office savings banks are only about savings and do

not offer credit and other services which are essential to make them real

banks, and work more inclusively. The main idea behind the Post Bank of India

is to make available the entire range of banking services.

Now let’s look the financial muscle of the post banks savings scheme as

it exists today.

The savings banks scheme has a whopping cash balance of about Rs 6 lakh

crore and about Rs 22.5 crore accounts. It also includes more than a million of

senior citizens’ savings schemes. The most striking part of this is that 89 per

cent of it serves the country’s rural areas. Significantly, all this money is

lent to state governments (its main source of public borrowing) and not to

loss-making airline companies.

The postal system also runs a low-premium Postal Life Insurance scheme

serving about 1.69 crore people. In the last two years, the Department has

invested about 10-20 per cent of the premiums in mutual funds with considerable

success. Its portfolio managers are as good or better than that of the regular

banks.

How will the Post Bank of India work?

For the Post Bank of India, the postal department will set up a

non-operating financial holding company which will float the bank, which will

be a private entity. it will have about 150 branches for which the head post

offices will be a correspondent. The access of the network will go all the way

down to the neighbourhood post office. The bank will have various products and

services that will strengthen financial inclusion.

The idea, for which everything is ready, is about real financial

inclusion that the existing banks will never be able to achieve in near future.

All that it requires from the government is an investment of Rs 700 crore.

Reportedly the RBI governor Rahguram Rajan will meet with finance

minister Chidambaram before announcing the licenses. If Chidambaram raises his

ministry’s objection, Rajan will have to either drop the license or defy the

government, although the latter is quite unlikely.

Sonia and Rahul, are you listening?

According to sources, Rahul Gandhi had been briefed about situation and

he had promised action, but as in other cases there was not enough follow up

from him.

If Rahul and Sonia are really keen about financial inclusion and

inclusive growth, it’s time that they intervened and broke one more silo that’s

preventing people-friendly policies and programmes. Blocking the Post Bank of

India is patently anti-people.

If

they don’t do it, it will be a fantastic opportunity for the next government to

make an impact. Perhaps, the BJP should take notes too.

Comments

Post a Comment