Budget 2014: Finance Minister Arun Jaitley Raises PPF Ceiling to Rs. 1.5 lakh

Finance Minister has enhanced the Public Provident Fund (PPF) ceiling from current Rs. 1 lakh to Rs. 1.5 lakh in a financial year. PPF is one of the most popular tax-saving schemes.

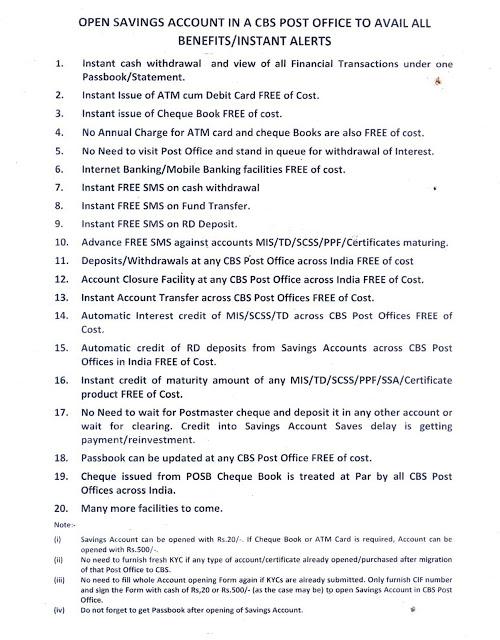

PPF accounts can be opened in a post office or designated bank branches. The interest rate on the PPF is linked to the market.

The PPF corpus is tax-free at all three stages. The investment is eligible for tax deduction under Section 80C. The interest earned is also tax-free, and so are withdrawals.

A PPF account matures in 15 years, but you can extend the tenure in blocks of five years after maturity.

PPF accounts can be opened in a post office or designated bank branches. The interest rate on the PPF is linked to the market.

The PPF corpus is tax-free at all three stages. The investment is eligible for tax deduction under Section 80C. The interest earned is also tax-free, and so are withdrawals.

A PPF account matures in 15 years, but you can extend the tenure in blocks of five years after maturity.

Comments

Post a Comment