SB Order No. 5/2014 : Changes in Statutory Rules in the backdrop of implementation of CBS- regarding

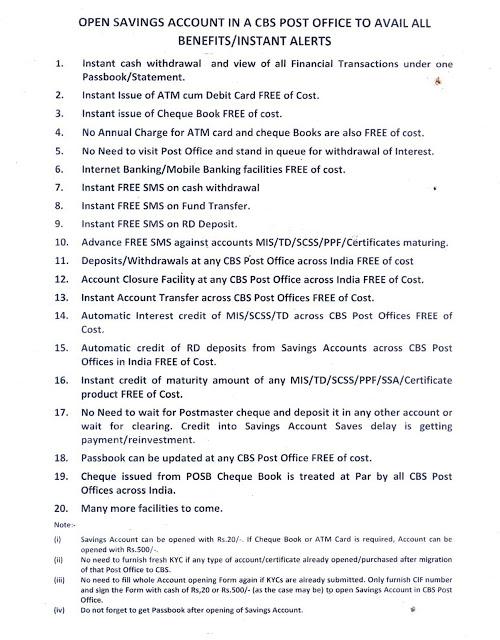

Vide Directorate SB

order No. 5/2014 dated 24.03.2014 the following Changes in Statutory Rules in

the backdrop of implementation of CBS.

1) Deposits and

withdrawals can be done through any electronic mode in CBS Post Offices.

2) Inter Post

Office transaction can be done between CBS Post Office.

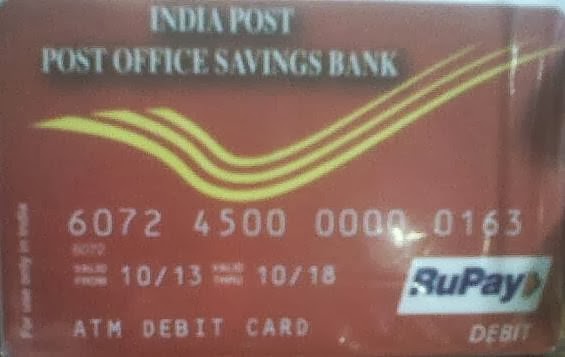

3) ATM/Debit Cards

can be issued to Savings Account holders having prescribed minimum balance on

the day of issue of card which will be circulated separately of CBS post

offices.

4) In case of

deposit made in RD Account by cheque. Date of credit of cheque into Government

Accounts shall be treated as date of deposit.

5) If next monthly

deposit in RD account opened between 1st and 15th of a month is not deposited

by 15th of following month and next monthly deposit in RD account opened

between 16th and last working day of a month is not deposited by last working

day of the following month , default fee @5 paisa for every 5 rupees shall be

charged .This will be applicable to both CBS and non CBS post offices.

6) If in any RD

account ,there is monthly default(s) the depositor has to first pay the

defaulted monthly deposit with default fee and then he can pay the current

month deposit. This will be applicable for both CBS and non CBS post offices.

7) In CBS post office

,when any TD account is matured , the same TD account will be automatically

renewed for the period for which the account was initially opened.e.g.2 years

TD account will be automatically renewed for 2 years. Interest rate applicable

on the day of maturity will be applied.

8) Lock up period

for six months for premature closure of TD account has been removed and as and

when any TD account is closed before one year, interest @ savings account

applicable from time to time shall be payable. This will be applied for both

CBS and Non CBS post offices.

9) In Case of MIS

accounts standing at CBS post offices. Monthly interest can be credited into

savings account standing at any CBS post office.

10) In Case of SCSS

accounts, quarterly interest shall be payable on 1st working day of April, July,

October and january at any CBS post Office.

11) Quarterly

interest of SCSS accounts of SCSS accounts standing at CBS post offices can be

credited in savings account at any other CBS post office.

12) minimum amount

for opening of PPF account shall be Rs 100/- for all CBS and non CBS post

offices.

13) In case NSC

VIII and IX issue ,transfer of certificate from one person to another can be

done only once from date of issue to date of maturity.

14) At the time of transfer

of Certificates from one person to another, old certificate will not be

discharged. name of old holder shall be rounded and name of new holder shall be

written on the old certificate and Purchase application ( in case of non CBS

post offices ) under dated signatures of the authorized Postmaster along with

his designation stamp and date stamp of Post Office.

15) Rule relating

to Conversion of one denomination of certificate to other denomination is

deleted.

This may kindly be

circulated to all field units for guidance and necessary action. These changes

should also be placed-on the Public Notice Board of all the post Offices. Post

Office working in Sanchay Post shall continue to follow the existing procedure

till new Patch is deployed in Version 7.5.

Comments

Post a Comment