Post Bank of India: a missed opportunity for UPA-II

Armed with all necessary approvals from various stakeholders, including

the Planning Commission and the Ministry of Finance, the DoP had

submitted its application with the Public Investment Board to be put

before the Cabinet Committee on Economic Affairs (CCEA) for its approval

in January this year. But the matter is yet to be taken up.

The Reserve Bank of India (RBI), on Wednesday, decided

to keep in abeyance its decision to grant banking licence to the

Department of Posts (DoP) for setting up the Post Bank of India (PBI),

thanks to sheer indecisiveness on the part of the Congress-led United

Progressive Alliance (UPA) government that has been sitting on the issue

for the past three months.

Armed with all necessary

approvals from various stakeholders, including the Planning Commission

and the Ministry of Finance, the DoP had submitted its application with

the Public Investment Board to be put before the Cabinet Committee on

Economic Affairs (CCEA) for its approval in January this year. But the

matter is yet to be taken up.

In the meantime, the

RBI gave “in principle” approval for banking licences to IDFC and

Bandhan Financial Services Private Limited, but it did not consider the

PBI application as it did not had mandatory clearance from the

government. “The HLAC (high level advisory committee set up by the RBI

to look into the issue) had also recommended that in the case of

Department of Posts which has applied for licence, it would be desirable

for the RBI to consider the application separately in consultation with

the Government of India,” the RBI statement said.

However,

this has given some relief to those engaged in the project in the DoP

and the government as their application was not turned down by the RBI.

And now they reason that the Cabinet can still decide on the issue

without losing any time. “The Election Commission of India gave the RBI

permission to decide on the licence grant as it was a routine matter.

Similarly, the Union Cabinet can also decide on the issue and let the

DoP get approval from the RBI...The issue of the model code of conduct

being in force is irrelevant here,” a senior government official said.

But

what puzzles many in the government is the reluctance on the part of

the Ministry of Finance to speed up the DoP application, particularly

when it would supplement the UPA government’s commitment towards

financial inclusion as the wide reach of the DoP would ensure that even

those living in remotest areas of the country get banking facilities.

“The

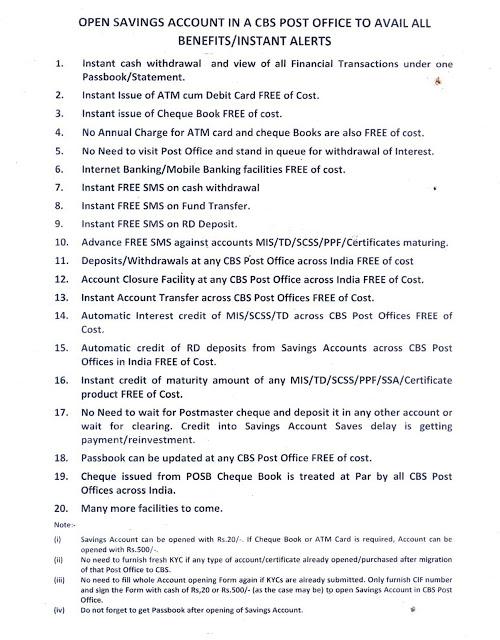

PBI would use over 1.3-lakh post offices as business correspondent for

the last mile reach in rural areas. These post offices will foster

government’s financial inclusion agenda by providing simple yet the

complete suite of financial products, including deposits, loans,

insurance, remittances, pension products and government subsidies,” a

senior official said.

Interestingly, the PBI will run

on a unique model where just 150 branches would be opened over the next

five years and manned by 3,000 employees, and these would be linked to

800 head post offices across India, which will further be connected to

25,000 sub-post offices and these to 1.3-lakh branch post-offices in

remote and rural areas, including places such as North-East and

Naxal-hit areas.

In its application to the RBI, the

DoP has stated that the PBI would need Rs.1,800 crore as total capital

investment, of which the government’s contribution would be just Rs.700

crore while the rest would be arranged from domestic and foreign

investors.

The PBI is expected to have a turnover of over Rs.21,000 crore in five years with a profit of Rs.300 crore.

Comments

Post a Comment