UNION HEAD QUARTER Bulletin No. 08 Dated: 30.04.2016

Bulletin No. 08 Dated: 30.04.2016

To,

All CHQ Office Bearers, Circle Secretaries and Members,

Dear Comrades,

I welcome the new members who have given declaration during this month of April-2016 and appreciated their faith with our Union for having shown their support by enrolling as New Members of AISBCE Union. It shows that all of you realized AISBCE UNION is the only service Union for SBCO cadre by solving our problems with good relationship with administration suggested in the matters of New Recruitment, Regional transfer allotment and other grievances. In our Union only, all the monthly/bi-monthly/four monthly meetings with Divisional level, Regional PMGs and Circle level with CPMG are being attended by our Circle Secretaries, ACS &Divisional Representatives

MAY DAY

GREETINGS

Let us we all remember the historical International Workers day of May Day on 1st May 2016 , which is remarkable for the achievement of eight hours of duty to working class. I on behalf of our AISBCE Union convey my “May Day Greetings” to all comrades.

Seventh Pay Commission: GOVT LIKELY TO IMPLEMENT 7th PAY COMMISSION AWARD AROUND SEPTEMBER-OCTOBER-2016

New Delhi: The Central government employees will have to wait till September-October to get higher salaries under the 7th Pay Commission. As per a Financial Express report, government is expecting that higher salaries released around the festival period starting with Durga Puja and Diwali will boost consumption, which will have a multiplier effect on the economy. Though the employees will get arrears with retrospective effect from January 1, no retrospective arrears in allowances will be given. With the move, the exchequer would be able to save around Rs 11,000 crore. The commission had estimated the additional outgo in FY17 due to its award at R73,650 crore. Source: http://zeenews.india.com- April 25, 2016

QUARTER OF FINANCIAL YEAR 2016-17, ON THE BASIS OF THE INTEREST COMPOUNDING/PAYMENT BUILT-IN IN THE SCHEMES, SHALL BE AS UNDER:

INSTRUMENT

|

RATE OF INTEREST W.E.F. 01.04.2015 TO 31.3.2016

|

RATE OF INTEREST W.E.F. 01.04.2016 TO 30.6.2016

|

SAVINGS DEPOSIT

|

4.0

|

4.0

|

1 YEAR TIME DEPOSIT

|

8.4

|

7.1

|

2 YEAR TIME DEPOSIT

|

8.4

|

7.2

|

3 YEAR TIME DEPOSIT

|

8.4

|

7.4

|

5 YEAR TIME DEPOSIT

|

8.5

|

7.9

|

5 YEAR RECURRING DEPOSIT

|

8.4

|

7.4

|

5 YEAR SENIOR CITIZENS SAVINGS SCHEME

|

9.3

|

8.6

|

5 YEAR MONTHLY INCOME ACCOUNT SCHEME

|

8.4

|

7.8

|

5 YEAR NATIONAL SAVINGS CERTIFICATE

|

8.5

|

8.1

|

PUBLIC PROVIDENT FUND SCHEME

|

8.7

|

8.1

|

KISAN VIKAS PATRA

|

8.7

|

7.8 (WILL MATURE IN 110 MONTHS)

|

SUKANYA SAMRIDDHI ACCOUNT SCHEME

|

9.2

|

8.6

|

THANE-421201 - MAHARASTHRA CIRCLE]

BIG BLUNDER COMMITTED BY THE VII PAY COMMISSION

RETENTION OF 3% INCREMENT IN VII CPC RECOMMENDATIONS IN CASE OF PROMOTION LEADS TO LOWER FINANCIAL BENEFITS BY FEW THOUSANDS THAN THE EXISTING BENEFITS UNDER 6TH CPC RECOMMENDATIONS:

The financial benefit would be much lower than what a government servant would be getting under VI CPC recommendation on promotion, because the existing benefit on promotion carry change in grade pay apart from 3% increase in Pay+Grade Pay. The following illustration shall show the huge difference:

Suppose an employee whose Pay is Rs.10400/- and the Grade pay is Rs. 2800/- totaling to Rs.13200(in the Pay band of 5200-20200), gets his next promotion to the Grade Pay of Rs.4200/- he will be entitled to the following hike in total remuneration under the existing VI CPC recommendation as a result of promotion:

Rs.13200 x 3% increment =Rs.400Difference in Grade Pay from Rs.2800 to Rs.4200= Rs.1400

Total increase of increment in basic pay and Grade Pay= Rs.1800

D.A. at 125% as on 1/1/2016 on Rs.1800 = Rs.2250

HRA at 30%(assuming X city) on Rs.1800 =Rs.540

Total monetary benefit = Rs.4590/-

Whereas the net monetary benefit under VII CPC recommendation, as a result of promotion in the above case will be much lower than the above illustration as shown under:

Equivalent Basic Pay for Rs.13200 come to Rs.33900 as per pay matrix

Rs.33900 x 3% increment =Rs.1017(placed at Rs.35,400 as per pay matrix in the next level)

Total difference Rs.35400 – Rs33900 =1500

D.A. at 0% as on 1/1/2016 on Rs.1500= 0

HRA at 24%(assuming X city) on Rs.1500 =Rs.360

Total monetary benefit = Rs.1860/-only as against the existing Rs.4590/- leading to shortage of Rs. 2730/-

Therefore the increment on promotion should be at least 5 to 6% to bring the benefit of increment on

promotion to the existing level.

Whether increase of percentage for annual increment is considered or not, but increment of percentage for promotions definitely need to be implemented to bring the level of monetary benefit to the existing level.

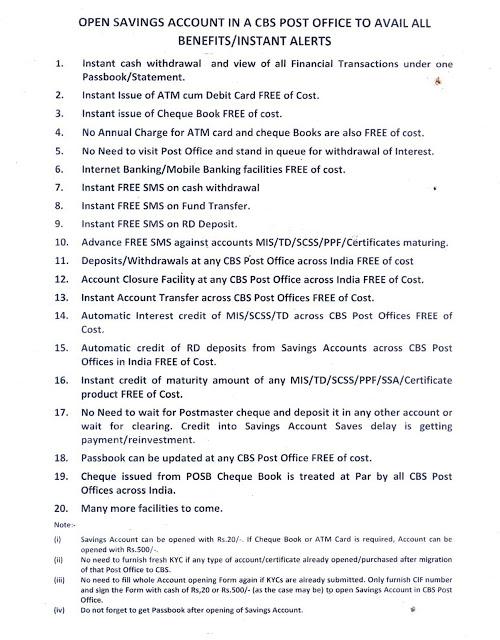

Generation of consolidation of transactions of SOs along with HO at HO from Finacle is very easy.

· First log in to Finacle

· Go to menu HFINRPT

· Select respective consolidation menu to generate consolidation of that scheme

· Consolidation report menus and their serial number in HFINRPT Menu are given below

28. Consolidated MIS Account Journal of Deposits and Withdrawals

29. Consolidated PPF Account Journal of Deposits and Withdrawals

30. Consolidated RD Account Journal of Deposits and Withdrawals

31. Consolidated Report On Certificates Discharged (NSC/KVP)

32. Consolidated SCSS Account Journal of Deposits and Withdrawals-SCSS

33. Consolidated Savings Account Journal of Deposits and Withdrawals-Savings

34. Consolidated TD Account Journal of Deposits and Withdrawals

34. Consolidated TD Account Journal of Deposits and Withdrawals

Now, if you want to generate RD consolidation from Finacle, then select " Consolidated RD Account Journal of Deposits and Withdrawals"

· In the field for SOLID/SET ID - Enter the SET ID of your HO (SET IDs will be unique for each HO. If you don't know your SET ID, contact your System Admin or CPC)

· Enter date in the field " To Date"Please see the image given below

CIRCLE CONFERENCE: In the following Circles, the Circle conference were held and the following office bearers were re-elected as Circle Secretary.

KARNATAKA CIRCLE: SRI. KESAVA RAO

MAHARASTHRA CIRCLE: SRI. P.A.MHATHRE

I, on behalf of our Union wish them to render their best Union service to their Circle members

RESOLUTIONS PASSED IN ALL INDIA CWC MEETING HELD AT AMRITSAR -05.03.2016 & 06.03.2016

- It was resolved that the West Bengal Circle is empowered to file CAT case at Kolkatta for Audit status of the SBCO staff.

- SB Order No. 14/2015 is against principle of auditing hence it is protested. Action on will be sent to Directorate to review and modify the Order.

- All HSG I supervisors in SBCO should be given Gr. B Gazetted status like ASP.

- As stated in SB Order No. 14/2015 SO SB branch should immediately attached to SBCO for checking of vouchers.

- Five days week working should be implemented to SBCO staff as SBCO is back office work like Division office and Circle Office.

- The work of preparation of consolidated journals of all categories allotted to SBCO vides SB Order No. 14/2015 should be taken back. One PA from SB SO branch should be attached under Assistant Postmaster SB HO for this work.

- The SB Order No 14/2015 should be modified. SBCO should be ordered to check all vouchers above Rs. 20000/= instead of Rs.5000/=. The present voucher checking system is not possible within available staff and with the slow process of Finacle server.

- HO SB Counter and all the SOs should be directed to send hard copies of lists of transaction either PDF or excel copies for which the generation of LOT took long time process and also as due to insufficient staff strength, it is not possible for SBCO to take print out of list of transactions of all the SOs and of all the categories.

- SBCO staff should be brought under direct control of DAP/Accounts Officer ICO (SB) and audit status should be given to SBCO for free and efficient checking of SB transactions.

- Preservation period and procedure of SBCO records should be reconsidered on par with nationalized banks. After checking the vouchers, it should be sent to record office for preservation. The post of record keeper should be created to maintain the records.

- Since the MIS server is not being updated regularly, the previous period LOTs are not being generated. SBCO has to check previous period work. Therefore SOs should sent copies of LOTs to SBCO along with vouchers. Bandwidth of the network should be increased as per requirement.

- Submission of RD/MIS closed accounts pass books to SBCO should be stopped as all the data is available in finacle.

- Every official retiring on superannuation must get all the dues on the date of retirement.

- One committee has been formed to review all the cases of recovery on SBCO staff and guide legal opinion. Shri Deepak Sharda, Circle Secretary, Punjab Circle C/o SBCO Jalandher City HO will be Secretary and General Secretary will be Chairman of the said committee. There will be seven members in the committee. All the officials undergoing recovery punishment and charge sheet will send their cases to secretary of the committee. The committee will take decision to fight the case in principle bench of CAT at New Delhi.

- One additional increment should be given those who retire between January to June.

DIRECTORATE REPLY TO OUR UNION IN RESPONSE TO OUR UNION LETTERS DATED: 10.02.2016 IN CONNECTION WITH FOLLOWING SUBJECTS WITH REFERENCE TO THE SB ORDER NO: 14/2015

Sub : Suggestions regarding SBCO - LOT checking after CBS implementation -Reg.

Sub : Suggestions regarding SBCO voucher checking after CBS implementation -Reg.

Sub : Request to maintain the audit status in SBCO branch in CBS environment-reg

REPLY GIVEN BY THE DPS, CBS: It is informed that the above subjects have been considered by the competent authority and it is conveyed that steps are being taken to improve efficiency of MIS server. LOT as well as other reports can be generated in MSEXCEL also for which user has to select the type of report in EXCEL instead of PDF form the dropdown given at the start of the report menu. As regards General check of vouchers, this practice is also being followed in Banks. Your other suggestions will be examined in due course.

However, our Union will take action again with Directorate on the following points.

Regarding LOT checking, we have two major problems

1. LOT generation in EXEL format is also having the same slow process and the man power is put in to waste until generation of LOT.

2. A check box is necessary in the LOT format for having verified the voucher with LOT, Otherwise, it could not be possible to cross check the vouchers whether it is verified with LOT or not. In case of any omissions, it could not be possible to trace the voucher number with LOT.

Regarding voucher checking, there is two type of voucher checking in SBCO.

1. General checking - This check is being done for all vouchers of all categories. It is no problem.

2. The other one checking is 20% of vouchers, all closures and 4% of deposits checking for all categories. It is a repeated work in addition to the check of counter & Supervisor check. Instead of this checking, we suggested the checking of vouchers which are having over corrections and misquotation of accounts number. It was already decided in the Group of meeting at Chennai headed by the DDG. Hence separate clarification for voucher checking is required.

EASY METHOD TO VERIFY RD TRANSACTIONS IN DOP FINACLE

VERICATION OF RD TRANSACTIONS IN SUPERVISOR:

1. Use HFTI command. Enter “ General Ledger subhead code “ as 30010

2. Have a look at transactions from date and to date.

3. Click on GO

4. Then all RD Entered transactions will be displayed there.

5. Select all (only table). Copy and paste it in Excel sheet.

6. Remove all columns except “Transaction ID”, “Status” columns.

7. Remove all rows where “Status” is “Verified”. We do not need them for verification.

8. Select all, Right click and select “Format cells “option in the list.

9. Switch to “ Allignment “ tab, uncheck “ wrap text “ option under “ Text Control “

10. Click CTRL+F, switch to “Replace” tab and enter “/2” in find what text box, and leave blank in “replace with” text box. Then “/2” in transaction ids will be removed.

11. Now invoke CRDP command. Select POST function, copy and paste Transaction id from excel sheet in Transaction ID text box.

12. Click F4 for GO, click F10 for submit. Again F4 for reload CRDP command.

13. Repeat the process for all pending transactions ids.

Note:

v Use HTV for auto verification of SB, SSA (up to 5000), MIS INT, SCSS INT, TD INT and VAULT OPERAIONS, AGENT Lists verification.

v Use HCASHPND for debiting cash from teller account for all type of accounts closed by CASH mode.

10 INTERESTING FACTS ABOUT INDIA POST

India has the largest postal network in the world with 1,54,939 post offices as on March 31, 2015, of which 1,39,222 (89.86%) are in the rural areas. At the time of independence there were 23,344 post offices.

Following are some interesting revelations from India Post’s annual report 2015-16.

1. The government has decided to digitize 1.5 lakh post offices across the country, which includes 1.3 lakh post offices in rural areas.

2. One can buy exclusive collection of postal stamps offered by India Post on e-commerce websites like Snap deal and Shop clues. Philatelic products are also available at e-post office – an e-commerce portal of India Post. Through its e-commerce portal, India Post also provides select postal facilities using the web. The department has generated revenue of Rs 24.31 lakh between April 2015 and December 2015 by selling postal stamps.

3. India is one of the earliest active members of the Universal Postal Union (UPU), a specialized agency of the United Nations, having its headquarters at Berne, Switzerland.

4. There are more than 33.03 crore account holders of the savings scheme of the department.

5. The outstanding balance under all the savings schemes and saving certificates in Post Offices are over Rs 6,19,317.44 crore.

6. Money transfer service of India Post enables instant international money remittance to customers in India sent from 195 countries on real time basis. This service is operational in association with Western Union from 9,942 post office locations and Money Gram through 6,070 post office locations.

7. To ensure safe and timely delivery of goods, the department has signed an agreement for supply and installation of GPS devices in 990 mail vans. GPS devices have already been installed in 926 mail vans.

8. India Post ATMs have been installed in more than 500 locations across the country.

9. The department has earned revenue of Rs 2,247 crore during the period April 2015 to December 2015 registering a growth of 15% compared to corresponding period last year.

10. The department has 38 heritage buildings having architectural value.

[SD: P.A.MHATHRE, GENERAL SECRETARY]

Comments

Post a Comment