AISBCEU HEAD QUARTERS BULLETIN DATED 26.12.2014

(Service union under Dept. of Posts)

[HQ- # 32 RANI KATRA CHOWK, LUCKNOW 226 003 UTTAR PRADESH CIRCLE

P.A.MATHRE

R. K. TANDON

P.K.MISHRA

PRESIDENT GENERAL SECRETARY

TREASURER

SBCO, MAHIM HO

O/ O CPMG, U.P.CIRCLE

CPU, New Hyderabad

MUMBAI-400016

LUCKNOW – 226001 LUCKNOW – 226007

CELL: 09819188067

CELL: 09415025900, 09616500831 09451028656

Email: prakashamhatre@gmail.com Email:

rakeshshobha@gmail.com

CHQ BULLETIN: 11 DATE:

26.12.2014

To

All Circle Secretaries

Dear Comrades,

I am very happy to meet you

all through this bulletin in the Happy New Year 2015. I wish all Comrades and all your family

members that the New Year 2015 is a messenger of Joy, Happiness, smiles and

good tidings for you and your family.

In

the coming New Year 2015, it is expected that most of the changes are going to

be introduced in our Department with a proposal a holding company under the

Department of Posts with 5 different verticals. Three verticals- Banking,

Insurance and E-commerce --can start working immediately. "Government

services and B2B vertical can start as we go along," Subramanian, also a former

Cabinet Secretary, said. The task force was set up to study leveraging of

postal networks for providing multi-disciplinary services to both individual

and businesses.

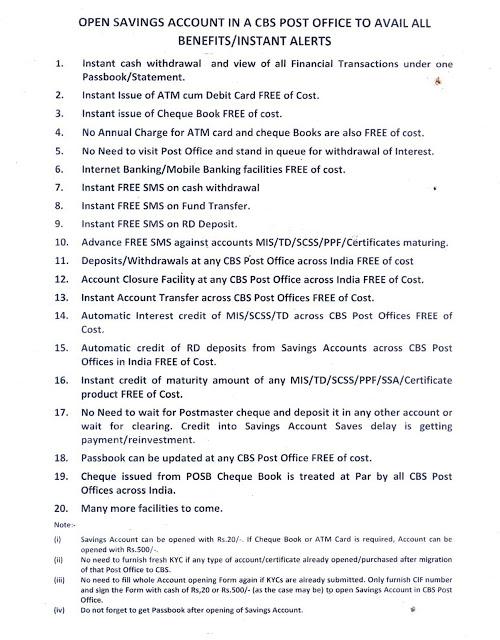

During this year, the CBS will also be

implemented in most of the 60% Post offices including HO/SOs and it may be

implemented in all 100% post offices before the end of year 2016. In view of

the CBS implementation, it is expected that some changes in the working

procedure which are already demanded by our Union may be ordered shortly. However,

Our Union will discuss this issue in the Directorate during our visit shortly

in the month of January 2015.

Our

Union All India Conference is due in the month of Feb/Mar-2015. Our CHQ

President had already given assurance to hold the AIC at Maharashtra Circle. I

do hope that Our CHQ President Sri.P.A.Mathre will make arrangements to hold

the AIC and the CHQ notice will be issued shortly with the information of Venue

and Date of AIC to your kind information.

|

NO REDUCTION IN RETIREMENT AGE: There

is no proposal under consideration of Government to reduce the retirement age

from 60 to 58 years for its employees. The retirement

age for Central Government employees was revised from 58 to 60 years in 1997

on the basis of recommendations of the 5th Central Pay

Commission.

The Centre’s

total wages and salaries bill for its employees for the year 2010-11, 2011-12

and 2012-13 is Rs. 85,963.50 crore, Rs. 92,264.88 crore and Rs. 1,04,759.71

crore, respectively. This was stated by the Minister of State for

Personnel, Public Grievances & Pensions, Dr. Jitendra Singh in a written

reply to Sardar Sukhdev Singh Dhindsa, Dr. T Subbarami Reddy and Smt. Ambika

Soni in Rajya Sabha, today. [Min of

Personnel, Public Grievances & Pensions]

|

|

Copy of the

D.O.Lr. addressed to Ms.

Kavery Banerjee, Secretary [Post] vide No: CHQ/14-SBCO-Transfer cluster/AISBCEU/2014 Dated 28.12.2014

Respected Madam,

Namaskar.

I wish to bring your kind

notice about the recent SBCO staff Rotational transfer policy vide reference D.G. Posts letter No. 141-141/2013-SPB II dated

31.01.2014-Annexure that the SBCO staff are to

be transferred within the cluster of Divisions.

In

most of the Circles, the Head offices

are placed with a long distance of 100 KM to 200 KM. It was brought to

the notice of the Directorate about the hardship of the officials during the

rotational transfers and after accepted the grievances of the staff, it was

considered by the Directorate and the following clarification was issued vide

D.G. Posts letter No. 141-77/2000-SPB II dated

2.3.2000 [Copy enclosed] that 2-3 HPOs as far contiguous as possible should be grouped together

and the SBCO staff transferred to such group of HPOs after they complete

their prescribed tenure.

Our

Union had already taken this matter with DDG[P] vide our Union letter Lr.No:

CHQ/10-SBCO- cluster/AISBCEU/2014 Dated 30.09.2014. But, so far no

modification is issued. Hence, it is kindly requested to reconsider the

transfer policy issued as referred in the above letter Dated: 31.01.2014 may

please be modified as group of 2-3 HOs instead of cluster of divisions

to protect the welfare of staff and their families. Since the

Rotational transfer process will start in the month of Jan-2015, our Union is

kindly requested to issue the modification of transfer policy guidelines as

early as possible to avoid hardship to the low paid employees.

Thanking You, Madam.

[R.K.TANDON General Secretary]

SB Order 10/2014 :

Regularization of irregularly opened MIS accounts in the multiples Rs.1000/-

instead of Rs.1500/- :

It has now

been decided by the Min. of Finance vide OM No. 01/02/2011-NS-ii(Pt-i) dt.

11.09.2014 to regularize all those MIS a/cs which have been opened in the

multiples of Rs.1000 instead of Rs.1500 in convention of POMIS Rules, 1987.

On notice of irregularity, the balance of amount in multiples of Rs.1500 be

kept in the account and the remaining amount in the account be refunded to

the a/c holder along with POSB rate of interest. The other terms and

conditions in r/o POMIS a/cs will remain as per Rules, 1987. Such a/cs may

only the regularized after taking necessary action against erring officials.

( SB Order 10/2014, AD SB-1, New Delhi dt.

19.09.2014 )

Government

launches special deposit scheme ( Sukanya Samriddhi Account ) for Girl child

: Finance Minister Arun Jaitley had announced the

scheme in his budget speech in July. The account can be opened and operated

by the natural or legal guardian of a girl child till she attains the age of

10, after which she can herself operate it but deposits in the account may be

made by the guardian or any other person or authority.

v The account could be opened in a post office or a public

sector bank. A depositor may open and operate only one account in the name of

a girl child under these rules after furnishing birth certificate of the girl

child along with other documents relating to identity and residence proof of

the depositor.

v Natural or legal guardian of a girl child will be

allowed to open accounts for two girl children only except if the depositor

has twin girls as second birth or if the first birth itself results into

three girl children.

v The government will notify interest rate on this scheme

every year. The account may be opened with an initial deposit of Rs 1,000 and

the reafter any amount in multiples of Rs 100 may be deposited, subject to

the condition that a minimum of Rs 1,000 will be deposited in a financial

year but the total money deposited in an account on a single occasion or on

multiple occasions shall not exceed Rs 150,000 in a financial year.

v Deposits may be made till completion of 14 years from

the date of opening of the account, the notification said. The account shall

mature on completion of 21 years from the date of opening of the account or

if the girl gets married before that.

v Withdrawals up to 50% will be allowed prior to maturity

for high education and marriage

([F.No.2/3/2014.NS-II]Dr.RAJATBHARGAVA,Jt. Secy. )

Copy of the D.O.Lr. addressed to Ms. Kavery Banerjee, Secretary [Post] vide No Lr.No:

CHQ/13-SBCO-CBS Accounting Procedure/AISBCEU/2014 Dated 28.12.2014

Respected Madam,

Namaskar.

I

wish to bring your kind notice about the important issue of statistical

information submitted to Postal Account by each SBCO branch every month to

generate the total no of Savings Bank transactions and Closing Balance of

each office in each category. It is very important statistical information to

generate the closing balance of each office and collect the commission from

Ministry of Finance for the operation of Savings Bank work.

At

present, CBS is implemented in every Post Offices and it is our target to

make our SB transaction business with easy process to the public like

implemented in all other banks. As per this CBS system, a public could make

transaction in his account from anywhere in India i.e. can deposit or

withdrawal money from his account from any CBS post office.

As per the latest Directorate

SB order: No 5/2014 Dated 24.03.2014, the following Changes in

Statutory Rules in the backdrop of implementation of CBS.

1) Deposits and withdrawals can be done through any

electronic mode in CBS Post Offices.

2) Inter Post Office transaction can be done between CBS

Post Office.

3) ATM/Debit

Cards can be issued to Savings Account holders having prescribed minimum

balance on the day of issue of card which will be circulated separately of

CBS post offices.

The main job of the SBCO branch

is the submission of statistical information to Postal Accounts every month

to generate the total no of Savings Bank transactions and Closing Balance of

each office in each category.

After

implementation of CBS, the SBCO branch is put in compulsion to submit the

wrong figures of statistical information to Postal Accounts for which no

separate accounting procedure for SBCO is prescribed by the FS Division of

directorate. Since all the CBS post offices are permitted to accept Deposits and withdrawals through any

electronic mode, the other office transactions are included with the

transactions and closing balance of main parent office instead of accounting

at parent office i.e. original account office of the concerned account. Due

to this wrong arrival of closing balance and number of transactions, the

closing balance of the main office will be modified with wrong closing

balance.

For example:

An account holder having account at Srinager CBS post office, withdraw money

Rs.80,000 at Chennai CBS office, the withdrawal amount will be included

with Chennai office transactions instead of Srinagar resulted to modify the

closing balance of both Srinagar & Chennai offices. If this kind of

transactions will be continued in all accounts, one day the closing balance

of all CBS offices will be modified with wrong figures.

Our

Union had already taken this matter with your office vide our Union letter

No: AISBCEU/CBS Problems/2014 Dated 15.03.2014 & Lr.No: CHQ/13-SBCO-CBS

Procedure/AISBCEU/2014 Dated 30.09.2014, but so far no revised accounting

procedure for SBCO branch is issued

from your office till date.

Our

Union suggests the following to your kind consideration for immediate effect

to avoid wrong arrival of closing balance in all the CBS Units.

If the above action would not be implemented in earlier, once all

office accounts closing balance will be modified with wrong closing balance

and also we may lose the commission claims from the Finance Ministry for

doing the Savings Bank agency service. If any more clarification is

required in this important matter, Our Union is ready to share our views with

Directorate in person.

This is for your kind information to consider this

matter with top priority to avoid wrong arrival of closing balances in the

CBS offices.

Thanking you, Madam.

[R.K.TANDON, General Secretary]

Copy to Shri

L.N. Sharma, DDG [FS] & Sri.

Sachin Kishore, Director [CBS], Dak

Bhawan, New Delhi-110001 for information

Air India Domestic Fare list

updated with LTC Scheme – LTC Fare List Nov 2014: Journey by Air Travel while availing LTC, stipulating that the orders

insisting to travel by Air India only.

v Group ‘A’ and Group ‘B’ officers (Gazetted and Non-Gazetted) are

entitled to travel by Air to NER on LTC. Other employees are entitled to

travel by Air to NER from Guwahati or Kolkata airport only.

v One more restriction of travel by Air India only need not apply to

non-entitled employees who travel by air and claim LTC reimbursement by

entitled class of rail.

v An employee can avail LTC to visit NER by conversion of one block of

home-town LTC. Reimbursement of the actual expenses on air travel while

availing LTC, will be restricted to cost of travel by the economy class only.

v To visit J&K by any Airlines subject to their entitlement being

limited to LTC-80 Fares of Air India.

Employees who are entitled to travel by rail by 2nd AC class for

availing LTC to Andaman & Nicobar Islands can travel by air. Air India

has now updated once again the fare list for LTC Scheme. ( Air-India-LTC-80-fare list-November-2014

Supreme Court ruled against recovery of

excess pay due to employers' mistake: Sunday, December

21, 2014

Recovery of

excess amount paid to Class-III and Class-IV employees due to employer's

mistake is not permissible in law, the Supreme Court has ruled saying that it

would cause extremely harsh consequences to them who are totally dependent on

their wages to run their family.

The apex

court said employees of lower rung service spend their entire earning in the

upkeep and welfare of their family, and if such excess payment is allowed to

be recovered from them, it would cause them far more hardship, than the

reciprocal gains to the employer. A bench of JS Khehar and Arun Mishra also

directed that an employer cannot recover excess amount in case of a retired

employee or one who is to retire within one year and where recovery process

is initiated five years after excess payment.

"We are

therefore satisfied in concluding, that such recovery from employees

belonging to the lower rungs (i.e., Class-III and Class-IV - sometimes

denoted as Group 'C' and Group 'D') of service, should not be subjected to

the ordeal of any recovery, even though they were beneficiaries of receiving

higher emoluments, than were due to them. Such recovery would be iniquitous

and arbitrary and therefore would also breach the mandate contained in

Article 14 of the Constitution," Justice Khehar, who wrote the judgment

said.

It said that the employer's right to recover has to

compared, with the effect of the recovery on the concerned employee and if

the effect of the recovery from the employee would be, more unfair, more

wrongful, more improper, and more unwarranted, than the corresponding right

of the employer, which would then make it iniquitous and arbitrary, to effect

the recovery.

"In such a situation, the employee's right would

outbalance, and therefore eclipse, the right of the employer to

recover," the bench said.

The bench passed the order on a petition filed by Punjab

government challenging Punjab and Haryana high court order restraining it to

recover the excess amount paid by mistake to numerous employees over the

years.

It said we may, as a ready reference, summarize the

following few situations, wherein recoveries by the employers, would be

impermissible in law:

(i) Recovery from employees belonging to Class-III and

Class-IV service (or Group 'C' and Group 'D' service).

(ii) Recovery from retired employees, or employees who are

due to retire within one year, of the order of recovery.

(iii) Recovery from employees, when the excess payment

has been made for a period in excess of five years, before the order of

recovery is issued.

(iv) Recovery in cases where an employee has wrongfully

been required to discharge duties of a higher post, and has been paid

accordingly, even though he should have rightfully been required to work

against an inferior post.

(v) In any other case, where the Court arrives at the

conclusion, that recovery if made from the employee, would be iniquitous or

harsh or arbitrary to such an extent, as would far outweigh the equitable

balance of the employer's right to recover.

The court said a government employee is primarily

dependent on his wages, and such deduction from salary should not be allowed

which would make it difficult for the employee to provide for the needs of

his family and any recovery must be done within five years. Source

: Times of India

Yours faithfully

[R.K.TANDON, General

Secretary]

|

Comments

Post a Comment